Olá, boys and girls! Here you will find all the steps you need to take to register as a freelancer in Portugal. We are covering tax information, Green Receipts (“Recibos Verdes”) and Social Security contributions in this article so that you have as much information in one place as possible. You can also see this article from our partner, Global Citizen Solutions, concerning the Portugal Digital Nomad Visa that may be of use to you if you are thinking about moving to Portugal to work remotely.

Registering as a freelancer in Portugal

This is your all-in-one guide to becoming a freelancer in Portugal! Have you heard about “Recibos Verdes” (Green Receipts) before? If you are living in Portugal and you wish to work as self-employed or as a freelancer, you should get used to this term. But first, you have to register as a freelancer. At first this may seem a little complicated, but we will try to deconstruct everything in the simplest way possible. We hope this helps you.

Becoming a legal freelancer in Portugal

Whether you are a freelancer thinking about moving to Portugal or you’re already living in Portugal and you’re thinking about becoming a self-employed freelancer, there are some things you need to know. Knowing what the law says and obeying the requirements will help avoid future problems with the Portuguese tax and customs authority (“Autoridade Tributária e Aduaneira”). The tax office and their website is commonly called “Finanças” in Portugal (the website is in Portuguese only).

What you need

You will need to have a NIF (“Número de Identificação Fiscal”) which is a taxpayer identification number, the IBAN of a Portuguese bank account in your name and you have to be registered in the Portuguese tax system as being self-employed or a freelancer. As a foreigner, it’s easy to open a free, basic, bank account (“Conta Serviços Mínimos Bancários”) to help speed things up. You should know that the banks are required by law to offer this type of simple account. Then, when the time comes, at least six months after you begin your activity as a freelancer, you will have to apply for a Social Security Number. This way you will be able to pay your dues to the Social Security system and, in turn, have access to the benefits of doing so.

How to apply for a Social Security number (NISS) in Portugal

First, call 300 502 502 to make an appointment. This may take about a month depending on where you are living. Or you can go to a Social Security office (“Segurança Social”) closest to you and apply for a Portuguese social security number. You may be given an appointment time to come back.

At your Social Security appointment

Make sure you bring your NIF number and your passport or identification card if you are an EU, EEC, or Swiss citizen. You may also need to show your Certificate of Residency (“Certificado do Registo de Cidadão da União Europeia”), so bring that too. For non-EU citizens, on top of your NIF, identification and Residency Certificate, you may need to bring the necessary papers that entitle you to live and work in Portugal (the same ones you needed for your visa and residency permit). For example, if you are here because you are married to a Portuguese person, you will need to bring your Marriage Certificate. The whole process may take a couple of months before you receive your Social Security number (NISS). As a freelancer or self-employed person, it is important to note that you will be exempt from making Social Security payments for the first 12 months from the start of your activity. It’s good to sort out your number early though so you can be prepared.

First things first: Get your NIF

The taxpayer identification number (“Número de Identificação Fiscal” (NIF)) is a number that is assigned to you by the tax authority. It is a unique number, associated with you and your activities. The purpose of this number is to give the state information about all the money you earn, the expenses you have and the taxes you have paid. It is related to everything you do in Portugal that involves money: Opening a bank account, renting a house, shopping and more. If you are a European Union (EU) or European Economic Area (EEA) citizen, getting your NIF is fairly easy. If you are from another country, it is also possible but requires a few more steps. In any case, you should get it on the spot.

Step 1

Assemble the following documents:

Proof of address

If you are applying as a non-resident in Portugal, you can use your home country address as proof of address. Use a bank document, for example, as it has to be an official document with your name and address on it. If you are already a resident in Portugal, bring a document that shows the same information, but in this case one that shows your Portuguese address.

Identification

Don’t forget to bring your passport, especially if you are a citizen from outside the EU/EEA. If, on the other hand, you are an EU/EEA citizen, your national ID card should be accepted. However, if your national ID card doesn’t have your signature on it, then that could be a problem and you should bring your passport, just to be sure.

Step 2

Search for the nearest tax authority office. Use Google Maps and search for “Finanças” in order to make it easy to find. The bigger cities have tax authority offices in a “Loja do Cidadão”, a kind of citizens’ shop or office that provides many of the most frequented and needed services.

Step 3

Go there early! Like, really, really early in the morning! At least 15 minutes before opening time. That way, you can be sure you are one of the first to be called in and you don’t have to stand in line for hours waiting for your turn. Allow for a few hours for this step and bring a book.

Are you from another country outside the EU/EEU?

For those of you that said “Yes”, you must fill an extra requirement: Use a tax representative. A tax representative could be a person residing in Portugal. That means that he or she can be a Portuguese person or a person from abroad, but they must be legally living in Portugal. Your tax representative can also be a company. Don’t panic! This seems complicated but it isn’t. Find someone you already know in Portugal, someone who trusts you and ask them to help you with this. If you don’t know anybody in Portugal, you can hire a representative service. There are many companies that do this and they speak English. Here are two examples:

Getting your NIF is free of charge, but if you would like to receive a physical card with the number on it, get €6.80 ready. The cost of hiring a tax representative service can vary widely from business to business, case to case. Our best advice is to do your research, compare costs, and see if any friends or acquaintances in Portugal can offer recommendations. To facilitate this process, there’s a new third-party provider called GETNIFPortugal who take care of the whole NIF application on your behalf. All you need to do is apply online.

I have my NIF so now what?

Now that you have your NIF, you need to properly register as a freelancer. This means that you have to inform the tax authority office (“Autoridade Tributária e Aduaneira” or “Finanças”) that you will be working as self-employed. This process is known as “opening an activity”. Opening an activity will allow you to bill and send invoices to your clients and simultaneously informs the tax authority about the service and the value.

Here is how you do it

Get your password to log into the tax authority’s website (“Finanças”)

Before you even think about opening an activity, we highly recommend you ask for the password to access the online services of the tax authority’s platform. This is the site that will allow you to open your activity and also invoice your clients, do your taxes and more. It is only in Portuguese so ask a trusted friend to help you, if you need it. Go to the Finanças site and fill in the form. You will receive your password in your post box within about five working days.

Got the password? Next step: open your activity

Assuming you already have your password taken care of, it’s time to get busy and open your activity. You can do this personally at the tax office (the “Finanças” office we mentioned earlier) or online at Finanças. Note: If you choose to do it online, you first have to fill in all the information needed and then you will have to wait another five working days to get the letter with a code in your postbox. You must follow the instructions given on that document and insert the code on the site before you can go any further.

Details you must provide to register as a freelancer in Portugal

The information you will need in order to register yourself as a freelancer is:

- The service you will provide. Most freelancers are part of the list in Article 151 of the CIRS.

- Date of the beginning of your activity. It is really, really important that you only start your activity after you have opened your activity with the tax authority.

- The amount you estimate you will earn until the end of that fiscal year (January to December). This will determine if you will have to pay VAT or not. If you earn more than €10,000 per year, you will have to include VAT .

- Your IBAN of your bank account. You need to fill in your IBAN in order to associate a bank account to your tax profile.

Accounting

The next step of your registration process is to choose your type of accounting regiment. There are two possible scenarios:

Simplified Regiment

It is the more common one and, as the name suggests, it is simple. This is the one you will get by default from the tax authority. You will not need an accountant and your situation will not change unless you earn more than €200,000 a year. There is one downside, however: There is no allowance for the costs you have with your activity. Note that if this is your case, you also have to declare your income to Social Security. Keep reading, we will cover this below.

Organised Regiment

If you earn more than €200,000 per year, you are obligated to have an accountant and that will cost you between €150 and €250 per month. Your accountant will handle both the Finanças and the Social Security. The upside of this regiment is that all your expenses count when you present your income to the state. The downside is that you have legal obligations such as hiring an accountant and keeping elaborate yearly tax files. It is just as if you would be an actual company.

VAT (Value Added Tax) in Portugal

The next question you will probably face is: Do I have to charge VAT or not for my services? Do my bills or invoices have to show the VAT value or am I exempt from VAT? Well, as we mentioned before, it all depends on whether you anticipate earning more than €10,000 per year for your services or not.

If you earn under €10,000 per year

In case you will not cross the €10,000 per year limit, you are exempt from VAT and that must be written on your bills or invoices. That means you don’t need to add it to your service value. You must be careful with one thing, though: If you end up earning more than €10,000 in one year, you have to declare that to the state and you have until the month of January of the following year to do so.

If you earn more than €10,000 per year

Now imagine you know you will earn more than €10,000 per year. You have to charge VAT on top of your normal fee. And then, you will have to declare the value of the VAT you have received from your clients to the state on a quarterly basis. The limit is the 15th of the second month after the quarter. A little confusing, we know. Let us explain it. This means that if you received €X in VAT from 1 January until 31 March, then you have until 15 April to declare it and pay it to the state.

Got the basics?

Now that you know the basics and you are a registered freelancer, you can invoice your clients. To do this, you have three methods:

- Invoice your clients via your own tax authority page (“Finanças”) (recommended by us because it is the easiest and fastest way);

- Use a physical, paper invoice book certified by the tax authority;

- Use tax software or a programme certified by the tax authority.

Step by step guide to invoice your clients

Though the website is in Portuguese, we have detailed the steps for you to make it easier to set up an invoice. 1. Go to the Finanças Access page and enter your NIF and password; 2. On the left, click on “Todos os Serviços” (All Services); 3. Scroll down until you reach “Recibos Verdes” (Green Receipts) and click “Emitir” (Issue);

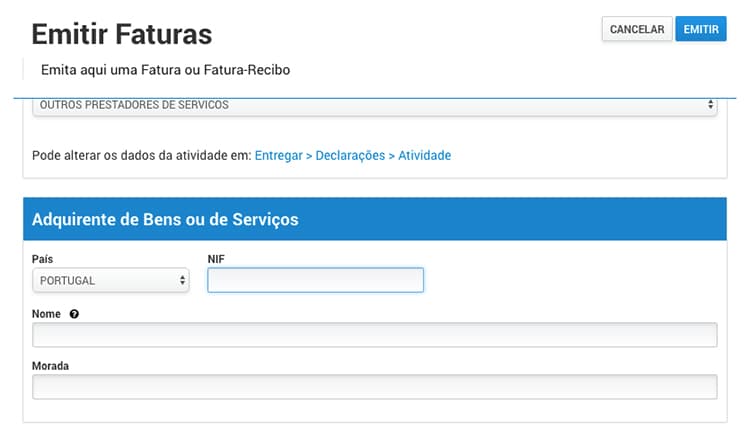

4. Choose the type of document you wish to issue: “Fatura-Recibo” (the common invoice known as a “Recibo Verde”) or “Recibo” (Receipt, in case you have previously sent the bill and you want to confirm that you have received the money); 5. Choose the service or activity you provided; 6. Insert the client’s NIF. In case your client is not from Portugal, select his country first in the box to the left and then fill in their tax number;

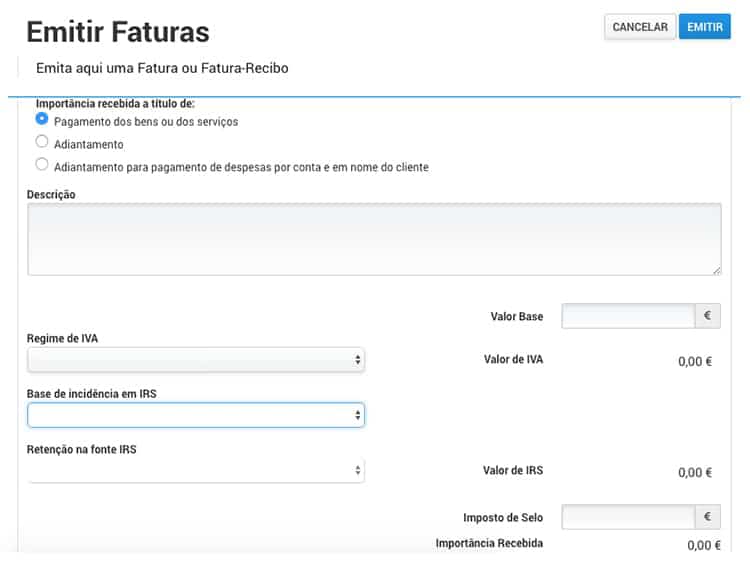

7. In the field “Importância recebida a título de:” (by way of, which means why you are charging your client), you can choose “Pagamento dos bens ou dos serviços” (Payment of goods or services). 8. Briefly describe the service in the “Descição” box; 9. Insert the value in “Valor Base”; 10. Select the VAT regiment (Exempt or Normal, depending on your case) under “Regime de IVA”; 11. On “Base de incidência em IRS” (IRS Incidence Base), choose “Isento” (Exempt, if you didn’t go over the €10,000 income for the year before) or choose 100% (if you did earn more than €10,000 that year); 12. On “Retenção na fonte de IRS” (Withholding tax on IRS) you have to choose 25% if you are not exempt (if your income was above €10,000 the year before) and in case your client has an Organised Regiment of accounting; 13. You can usually put 0 in the “Imposto de Selo” box unless your accountant instructs you otherwise. 14. Apply by clicking the blue “Emitir” button and print the document, sign it and send it to your client.

IRS Declaration in Portugal

Every person that has any income in Portugal must declare it and freelancers are no exception. Any person who has an open activity must do the same, even if they earned nothing for the year. This is a declaration you have to fill in every year in order for the state to evaluate if the taxes you have been paying during the year (VAT, Retention, etc.) were accurate. The tax authority will evaluate if you have paid enough (depending on your category) or if you have paid too much. In the first case, be prepared to pay a tax bill. In the second case, get ready to receive some money back!

Social Security contributions in Portugal

On 1 January 2019, there were some changes to the system that seems to scare or confuse a lot of those who work (or would like to work) as freelancers. Let’s try to make it simple. As we said in the beginning, you must also apply for a Social Security number. One of the reasons for this is, so you can pay your dues to the Social Security and, in turn, get access to all the services that Social Security provides or helps you with. We are talking about healthcare, education and much more. Starting 1 January 2019, if you are a freelancer with a Simplified Accounting Regiment (meaning you don’t have an accountant), these are some of the things you have to know:

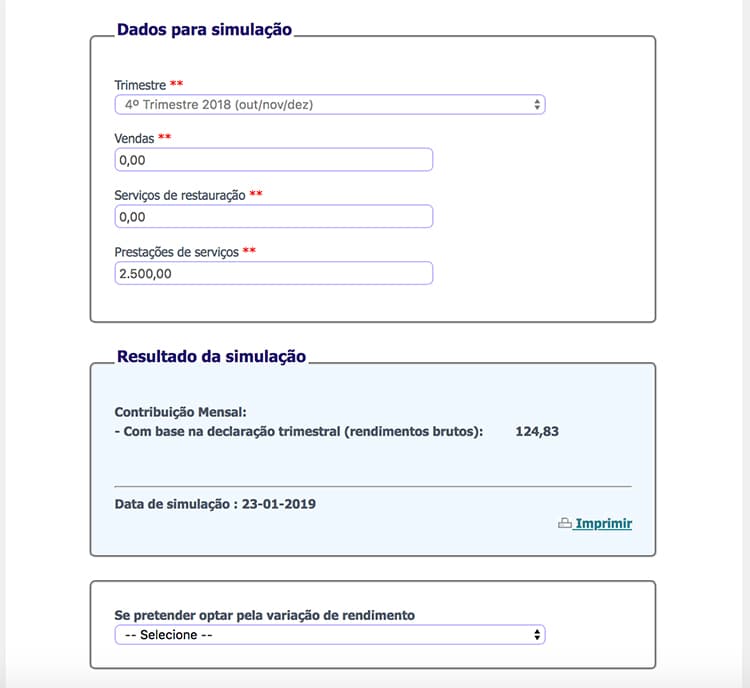

You must submit your declaration on a trimester basis

In order for Social Security to know how much your contribution needs to be, you have to declare how much you earned in the previous trimester. For example, during April you have to declare how much you have earned in January, February and March. Note that this begins in January 2019. This means that you have to submit the declaration of your October, November, and December 2018 earnings in January 2019. To make it really easy, use this simulator from the Order of Certified Accountants (“Ordem dos Contabilistas Certificados”) (website is in Portuguese) to calculate how much you can expect to pay each month. Here is an example of the simulator:

Pay your Social Security fees

After you submit your declaration, you will get a document from the Social Security named “Documento Único de Cobrança” or DUC. You must pay this bill between the 10th and the 20th of the following month.

How much are you expected to pay?

The contribution amount decreased from 29.6% to 21.4%. That means that as a freelancer, you will have to pay 21.4% of your Relevant Income to Social Security. You can choose to pay 25% more if you are interested in adding more value to your pension or to any other Social Security service, but you can also choose to pay 25% less, if you wish. What is the Relevant Income? Relevant Income is the percentage of your income for which you will have to pay your Social Security contribution. There were some changes in this area too that seem to scare people but it’s nothing to be afraid of. You have to calculate how much you have earned in the previous trimester. After you add all your income, work out 70% of that value. That’s your Relevant Income! For example, if you earned a total of €1,000 in the previous trimester, your Relevant Income is of €700. This means you have to take 21.4% of €700 which is €149.80 and that’s what you should expect on that DUC.

What if my income is zero?

In case you have no income in the previous trimester, you will still receive a DUC with a request to pay €20. This is in order for you to be able to have access to the Social Security’s services even without working.

What if I forget or get the values in the declaration wrong?

If you forget to submit your declaration, you receive the DUC bill for €20. When the DUC comes and you see that is not the sum you were expecting to pay (or you realise you have forgotten about it), you have five days to submit or change your declaration without paying any fine. After those five days, you will be fined by Social Security as soon as non-compliance to pay comes up. The wrong values can also be corrected when sending in the Annual Declaration to the Social Security.

What is an Annual Declaration?

This is not news in 2019. Every January, every freelancer must turn in a declaration concerning all the income of the previous year. This is an excellent opportunity to verify if there were any errors.

IRS, trimester and annual declarations comparison

After filling in the IRS declaration, the Social Security and the Finanças, cross-check your values and calculate if the values you have paid were right or if they must be corrected. This correction is taken into consideration in the DUC you will receive next.

Are there exceptions?

Simply put: Yes. If you are a freelancer in Portugal, but you also work as an employee for a company and earn more than €428.90 (this is the IAS which we will explain), you may be excused of paying the Social Security contribution. However, this only happens if your Relevant Income is less than four times the Social Help Index (“Indexante de Apoio Social” or IAS). This value can change on a yearly basis, but it represents the basis of the Social Security contribution. So, if your Relevant Income is less than €1715.16 and you earn more than €428,90 from your employer, you are excused from having to pay the Social Security contribution.

Where do I submit my declarations to Social Security?

You will have to have a Social Security Number and to be registered on the Social Security website (website is in Portuguese). You can order your password on the website, just as you did with the Finanças password detailed earlier. When you have all these requirements, you can log on the website and click on “Declaração Trimestral” (trimester declaration). On the following page check “Não” (No) if you had no income in the previous trimester. Check “Sim” (Yes) if you received some income. Then, fill in the income and its origin and click on “Próximo Passo” (Next Step). And then confirm. If you find this difficult, ask for help to fill in the first few declarations. It should get easier.

Getting help with your Social Security questions

The laws change quite regularly in Portugal, so we highly recommend getting some help with this from the Social Security office if you are not sure what to do. If you are self-employed or a freelancer and wish to contact the Portuguese government regarding these new Social Security requirements, you can call this number: 300 51 31 31. You can also get personalised support at the Social Security’s counter for independent workers “balcão do trabalhador independente”. Here is a list of addresses of the Social Security offices (“Segurança Social”). There are 18 offices around the country. This is a special service Social Security created until the end of January 2019, so that you can find out if you need to pay Social Security and how to do it. You don’t need to make an appointment in advance. For more information about the new rules, have a look at this press release (in Portuguese) from the Portuguese government.

Need more help?

We have done our best to help you get the right information you need in order for you to thrive in Portugal. We know, however, that this topic can be complicated. Each year there is something that changes, so the best thing you could do is to contact a certified accountant if you have any specific questions. You can also contact your local Finanças office and ask them questions. Rumour has it that the employees are not very kind, but that is not the norm. Just talk to them, reach out for help and be respectful and they will help you. Even in their most basic English, they will try to make your life easier. We hope you get the most out of this article and we wish you luck in your journey as a freelancer. Welcome to the freelance world! Did you find this information useful? Do you have any doubts about the process? Feel free to leave a comment below.Be sure to subscribe to our newsletter so you don’t miss the latest tips for your visit or move to Portugal.You may also be interested in:Portugal Money, What You Should Know About Cash in PortugalWhat is a NIF Number in Portugal and Why You Need OneOpening a Bank Account in Portugal, Tips from an ExpatBest Portuguese Banks: Manage Your Money and Keep it Safe